jersey city property tax assessment

The exact property tax levied depends on the county in South Dakota the property is located in. Financial Advisors in Austin TX.

New Jersey Education Aid Why Jersey City S New Unpiloted Skyscraper Will Help Taxpayers Not Necessarily The Public Schools

Arkansas has one of the lowest median property tax rates in the United States with only four states collecting a lower median property tax than Arkansas.

. This tax may be imposed on real estate or personal propertyThe tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate and is generally an obligation of the owner of the property. Assessor Merced County Assessor 2222 M Street Merced CA 95340 Phone. The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700.

World Education Services WES is a non-profit social enterprise dedicated to helping international students immigrants and refugees achieve their educational and career goals in the United States and Canada. Pay Property Taxes. It appears they are fleeing California because of.

Read breaking headlines covering politics economics pop culture and more. With innovative energetic leadership and committed partners Irvingtons future is brighter than. Which is called the residential assessment rate is recalculated regularly by the state.

South Dakota is ranked 23rd of the 50 states for property taxes as a percentage of median income. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income. The median property tax in Arkansas is 53200 per year052 of a propertys assesed fair market value as property tax per year.

Most local governments in the United States impose a property tax also known as a millage rate as a principal source of revenue. Yet at 089 Florida is slightly below the national average property tax rate of 111 and Texas is seventh highest in property tax rates at 18. The basic authority for the assessment of real property is derived from Article VIII Section 1 paragraph 1 of the New Jersey Constitution.

Get breaking Finance news and the latest business articles from AOL. The exact property tax levied depends on the county in Texas the property is located in. Property Tax Info admin 2021-03-08T145210-0500.

Top Financial Advisors by City and State. Therefore your tax rate only applies to that 21450. Implementing legislation is found in New Jersey Statutes Annotated Title NJSA.

Get information on latest national and international events more. Baltimore breaking news sports weather and traffic from the Baltimore City Paper. Arkansass median income is 48177 per year so the median yearly property tax.

Founded in 1692 Irvington is a distinctive community that merges the amenities of big-city living with the charm of attractive residential districts. Financial Advisors in NY. Meanwhile California is 16th lowest in property tax rates at 076.

Property shall be assessed under general law and by uniform rules. Harris County has one of the highest median property taxes in the United States and is ranked 152nd of the 3143 counties in order of median property taxes. From stock market news to jobs and real estate it can all be found here.

Harris County collects on average 231 of a propertys assessed fair market value as property tax. Find the latest US. Colorado Property Tax Rates.

Search Merced County property tax and assessment records by fee parcel number assessment number or address. Results may include owner name tax valuations land characteristics and sales history. Read latest breaking news updates and headlines.

Lincoln County collects the highest property tax in South Dakota levying an average of 146 of median home value yearly in property taxes while. King County collects the highest property tax in Texas levying an average of 156 of median home value yearly in property taxes while Terrell County has the. Some states include mapping applications whereby one may view online maps of the property and surrounding areas.

Many states offer online access to assessment records that may be searched by property address property id number and sometimes by owner name. Value is roughly 21450 300000 x 0715 21450.

42 Van Wagenen Condominiums Jersey City Nj Zillow

50 Counties With The Highest Lowest Property Tax Assessments Cheapism Com

Your Assessment Notice And Tax Bill Cook County Assessor S Office

The Official Website Of City Of Atlantic City Nj Property Tax Collector

Tax Collector S Office City Of Englewood Nj

New Jersey Property Tax Calculator Smartasset

Journal Square Jersey City Nj Homes For Sale Real Estate Redfin

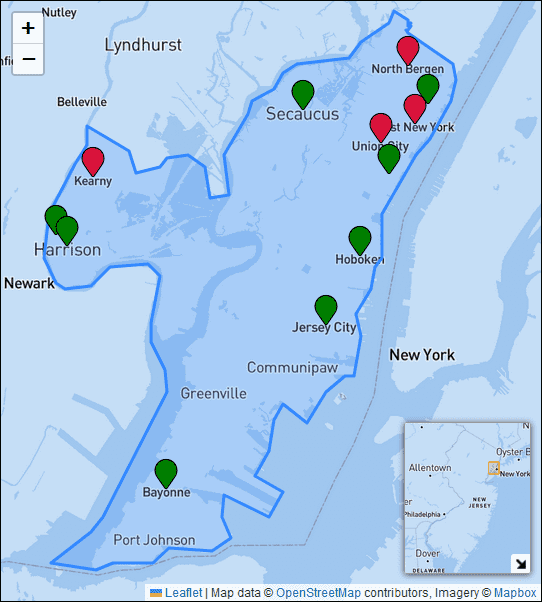

Jersey City New Jersey Property Tax Revaluation 2016 Ballotpedia

Here Are The 30 N J Towns With The Lowest Property Tax Bills Nj Com

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

How Do State And Local Property Taxes Work Tax Policy Center

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Property Tax In New Jersey New Jersey League Of Municipalities